| BSE SME's Exchange Data | |

|---|---|

| No. of Companies Listed on SME till Date | 456 |

| Mkt Cap of Cos. Listed on SME till Date (Rs.Cr.) | 88,421 |

| Mkt Cap of Currently Listed BSE SME Cos. (Rs.Cr.) | 27,373 |

| Total Amount of Money Raised till Date (Rs. Cr.) | 5,603 |

| Valuation Increase Since FY 2013 at BSE SME Platform | 15.78 times |

| Average return of BSE SME companies Since FY 2013 | 27.74% |

| No. of Companies Migrated to Main Board | 179 |

| % of Companies Migrated to Main Board | 39.25% |

| No. of Companies Listed as of Date | 277 |

| NSE SME's Exchange Data | |

|---|---|

| No. of Companies Listed on SME till Date | 342 |

| Mkt Cap of Cos. Listed on SME till Date (Rs.Cr.) | 79,653 |

| Mkt Cap of NSE SME Listed Cos . ( Rs.Cr.) | 29,792 |

| Total Amount of Money Raised till Date (Rs. Cr.) | 5,441.7 |

| Valuation Increase Since FY 2013 at NSE SME Platform | 14.64 times |

| Average return of NSE SME companies Since FY 2013 | 26.81% |

| No. of Companies Migrated to Main Board | 136 |

| % of Companies Migrated to Main Board | 39,76% |

| No. of Companies Listed as of Date | 206 |

As of 6th October 2023, BSE SME platform has listed 456 companies with a total market capitalization of Rs. 88,421 crore. Interestingly, the market capitalization of the companies currently listed on the BSE SME exchange totalling a staggering Rs. 27,373 crore, which signifies the strong performance of these companies since their listing. In fact, the average valuation increase of BSE SME companies since FY 2013 is 15.78 times, which is remarkable.

The average return of BSE SME companies since FY 2013 is equally impressive at 27.74%, which suggests that investing in these companies has been highly rewarding for investors. The BSE SME platform has witnessed 179 companies migrating to the main board, which accounts for 39.25% of the total number of listed companies. This indicates the growing success of these companies and their potential for further growth in the future.

Similarly, NSE SME platform has listed 342 companies with a total market capitalization of Rs. 79,653 crore. The market capitalization of the companies currently listed on the NSE SME exchange totalling a staggering Rs. 29,792 crore, which has also shown impressive growth since listing.

The valuation increase of NSE SME companies since FY 2013 is 14.64 times, and the average return of these companies since FY 2013 is 26.81%. Additionally, 136 companies have migrated from the NSE SME platform to the main board, which accounts for 39.76% of the total number of listed companies.

Overall, the data highlights the growth of the SME sector in India at the exchange platforms, and the impressive performance of the companies listed on the BSE SME and NSE SME platforms. These figures provide strong evidence of the potential for investment in the Indian SME sector and its continued growth in the future.

The BSE SME and NSE SME platforms have emerged as important sources of funding for small and medium-sized enterprises in India. According to the available data as of Oct 2023, the total amount of money raised in BSE SME is Rs. 5603 crore, while in NSE SME it is Rs. 5441.70 crore.

This is a significant achievement, as it demonstrates that these platforms have been successful in providing access to capital to small and medium-sized enterprises, which are often unable to raise funds from traditional sources such as banks and financial institutions.

The success of BSE SME and NSE SME can also be attributed to the transparency and efficiency of these platforms. These platforms offer a streamlined process for raising capital, which includes listing on the exchange, making disclosures, and providing investors with access to information about the company's financial performance.

Furthermore, the success of these platforms has contributed to the growth of entrepreneurship in India, providing a much-needed boost to the country's economy. Small and medium-sized enterprises play a critical role in driving economic growth, and the availability of funding through platforms like BSE SME and NSE SME has made it easier for entrepreneurs to start and grow their businesses.

In conclusion, the data on the total amount of money raised in BSE SME and NSE SME is a testament to the success of these platforms in providing access to capital to small and medium-sized enterprises in India. The availability of funding through these platforms has enabled entrepreneurs to start and grow their businesses, contributing to the growth of the Indian economy.

A glimpse into the investor interest in SMEs going public

In recent times, the craze for SME IPOs has been on the rise, with more and more small and medium-sized enterprises opting to go public to raise capital. This trend is reflected in the subscription statistics for recent SME IPOs, which have been oversubscribed more than 100 times, indicating an unprecedented level of investor interest in these companies.

The oversubscription of SME IPOs is a positive development for the Indian economy. It reflects the growing interest of investors in the SME sector and the potential for these companies to drive economic growth. As more and more SMEs go public, it is likely that we will continue to see strong investor interest and oversubscription of IPOs in the coming years. Below is the list of recent IPOs got oversubscribed by more than 100X.

| Company Name | Issue Size (Rs Cr) | QIB (x) | NII (x) | Retail (x) | Total (x) |

| Kahan Packaging Limited | 5.76 | 405.59 | 1042.37 | 730.45 | |

| Srivari Spices and Foods Limited | 9 | 79.1 | 786.11 | 517.95 | 450.03 |

| Madhusudan Masala Limited | 23.8 | 86.91 | 574.08 | 592.73 | 444.27 |

| Anlon Technology Solutions Limited | 15 | 54.53 | 883.58 | 447.06 | 428.62 |

| Arvind and Company Shipping Agencies Limited | 14.74 | 436.05 | 321.97 | 385.03 | |

| MCON Rasayan India Limited | 6.84 | 307.09 | 453.41 | 384.64 | |

| Quality Foils (India) Limited | 4.52 | 464.5 | 259.65 | 364.38 | |

| Basilic Fly Studio Limited | 66.35 | 116.34 | 549.44 | 415.22 | 358.6 |

| Krishca Strapping Solutions Limited | 17.93 | 36.1 | 786.89 | 572.83 | 336.57 |

| Goyal Salt Limited | 18.63 | 67.2 | 382.45 | 377.97 | 294.61 |

In recent times, the SME IPO market has garnered significant attention from investors, particularly Qualified Institutional Buyers (QIBs) and Foreign Portfolio Investors (FPIs). This is largely due to the potential for growth and high returns that the SME sector offers.

The SME IPO market has been gaining momentum in recent years, with many small and medium-sized companies going public to raise funds for expansion and growth. This trend has caught the eye of QIBs and FPIs, who are constantly on the lookout for new investment opportunities.

The appeal of SME IPOs lies in their potential for high growth and returns. Many SMEs operate in niche markets and have innovative business models that can generate significant revenue in a short period of time. This translates to high returns for investors who are willing to take on the risk.

In addition, the SME sector is considered to be an engine of economic growth, with the potential to create jobs and boost local economies. By investing in SME IPOs, QIBs and FPIs are not only looking to make a profit, but also to support the growth and development of small and medium-sized businesses.

In conclusion, the recent attraction of QIBs and FPIs to the SME IPO market is a positive sign for the sector as a whole. It not only provides much-needed capital for SMEs but also signifies a growing confidence in the potential of small and medium-sized businesses to drive economic growth and generate high returns for investors.

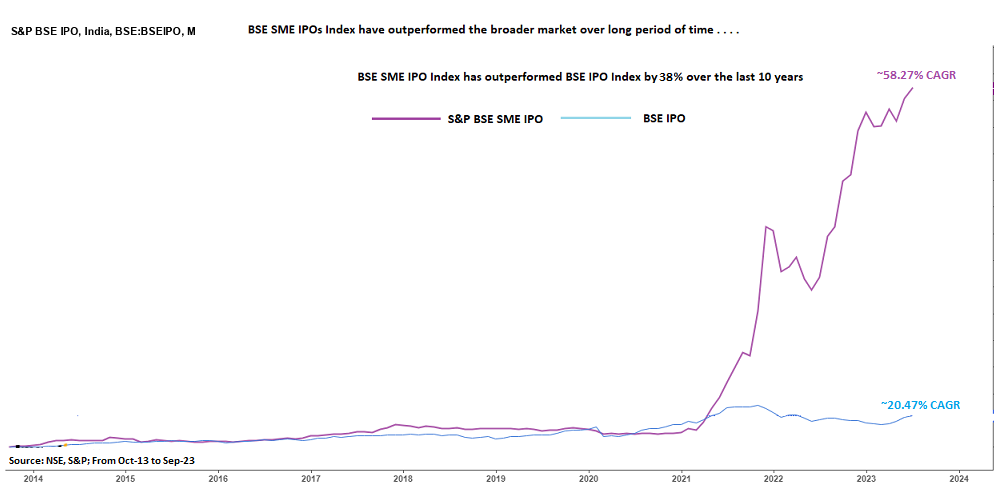

Investing in small and medium-sized enterprises (SMEs) has become increasingly popular in recent years due to the potential for high returns. The S&P BSE SME IPOs Index, which tracks the performance of SME IPOs in India, has demonstrated impressive growth over the past decade. In fact, over the last 10 years, the index has delivered a remarkable 38% higher returns compared to the S&P BSE IPO Index, highlighting the potential for lucrative investments in SMEs.

In addition, the S&P BSE SME IPOs Index has also shown exponential growth in the last three years. Despite the challenges posed by the COVID-19 pandemic, the index has continued to perform well, indicating a robust SME sector in India. The index comprises companies that have recently gone public and are looking to raise funds for growth and expansion. Many of these companies operate in niche markets with innovative business models, which can generate significant revenue in a short period of time.

Investing in SMEs can be risky due to their relatively small size and the potential for high volatility. However, the potential for high returns and the increasing number of successful SMEs in India make it an attractive option for investors looking to diversify their portfolio.

There are several opportunities in the SME (Small and Medium Enterprises) sector, including:

SMEs have the flexibility and agility to innovate and bring new products and services to market quickly. This can help them stay ahead of the competition and capture new markets.

SMEs can focus on niche markets that larger companies may overlook or consider too small to be profitable. This can give SMEs a competitive advantage and help them build a loyal customer base.

SMEs are often able to operate more cost-effectively than larger companies due to their lower overheads and streamlined processes. This can enable them to offer competitive prices and attract price-sensitive customers.

SMEs can provide a more personalized service to customers, building strong relationships and customer loyalty.

SMEs can partner with other SMEs or larger companies to access new markets or leverage each other's strengths.

Many governments offer support programs and funding opportunities specifically for SMEs, which can help them grow and expand their operations.

The SME sector is the backbone of the Indian economy, contributing over 30% to GDP and employing over 110 million people. The sector is expected to play a key role in India's economic growth in the coming years, driven by a number of factors, including: